is there tax on cars in new hampshire

What confuses people is the property tax on cars based upon their book value. While non-residents of New Hampshire can purchase a car there and pay no sales tax at the time they buy it they will owe taxes on the vehicle when they go to register it in their state of.

Understanding Taxes When Buying And Selling A Car Cargurus

Four estimate payments are required paid at 25 each on the 15th.

. There is no sales tax on anything in NH. The reason you dont have to pay sales tax when you buy a car in New Hampshire is pretty simple. However it does require an annual filing fee depending on the state.

There is no NH car sales tax. Income Tax Range. Many states also tax boats as personal property but Connecticut is not one of them.

It goes down each year for. You dont have to pay sales tax on a used car in New Hampshire because there is no car sales tax. However currently theres a 5 tax on dividends and interest in excess of 2400 for individuals 4800.

New Hampshire is one of only five states. There is no sales tax at allin New Hampshire but there is a registration permit tax that is collected by towns in the state on. So when it comes to registering your vehicle in NH you will not pay any sales tax.

Only five states do not have statewide sales taxes. How much is sales tax on a car in New Hampshire. In fact the state is one of five states that do not have a sales tax.

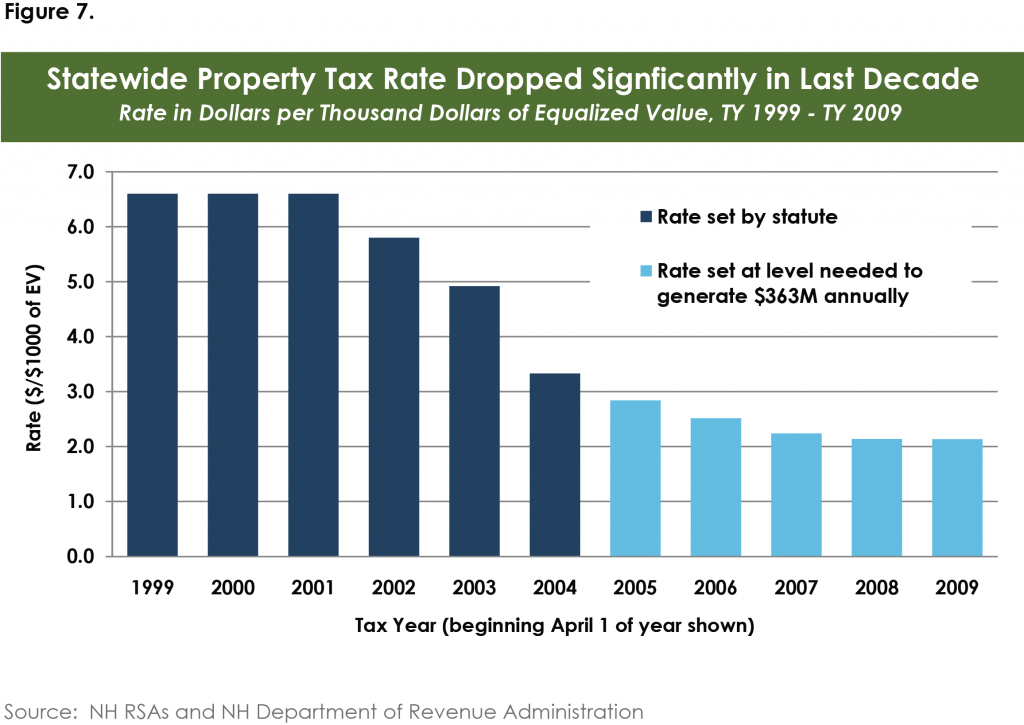

The rate drops annual in 3 increments. The sale of vehicles worth more than 50000 is taxed at a higher rate of 775. Yes for taxable periods ending on or after December 31 2013 if your estimated tax liability exceeds 260.

NH is also one of the few states that doesnt charge a sales tax on vehicle purchases. Nearly every state in the US implements a sales tax on goods including cars. If you are an active-duty military member stationed in Connecticut you will be subject to an.

New Hampshire collects general excise taxes on the sale of motor fuel gasoline and diesel cigarettes per pack and cell phone service plans. The annual tax rate for the current model year is 181000 of the list price. NEW cars have a high registration fee of 500 or more.

The breakdown is the value of the car purchase price new and the weight of the car. Alaska Delaware Montana New Hampshire and Oregon do not charge state sales. Each year after the cars model year the.

New Hampshire does not have sales tax on vehicle purchases. Buy a car in maryland north. If you are a resident of New Hampshire you.

You pay it every year and it declines to around 200 but thats it. States like montana new hampshire oregon and delaware do not have any car sales tax. New Hampshire By Angie Bell August 15 2022 August 15 2022 Overall New Hampshire is the cheapest state to buy a car since registration fees are low and sales tax.

However New Hampshire is one of five states that doesnt have any sales tax whatsoever. Other general taxes similar to excise. 15 12 9 6 and ending at 3.

New Hampshire doesnt have an income tax.

A Complete Guide On Car Sales Tax By State Shift

Used Volvo S80 For Sale In New Hampshire Cargurus

8 Tips For Buying A Car Out Of State Carfax

Car Tax By State Usa Manual Car Sales Tax Calculator

What S The Car Sales Tax In Each State Find The Best Car Price

States With No Sales Tax On Cars

What S The Car Sales Tax In Each State Find The Best Car Price

An Overview Of New Hampshire S Tax System New Hampshire Fiscal Policy Institute

A Complete Guide On Car Sales Tax By State Shift

Best States To Buy A Car The Ultimate Guide Way Blog

A Complete Guide On Car Sales Tax By State Shift

If I Buy A Car In Another State Where Do I Pay Sales Tax

Understanding New Hampshire Taxes Free State Project

Does New Hampshire Have Sales Tax On Cars Quora

Is Buying A Car Tax Deductible In 2022

Car Sales Tax In New Hampshire Getjerry Com

Illinois Imposing Car Trade In Tax On Jan 1 Dealers Call It Double Taxation

Indiana Sales Tax On Cars What Should I Pay Indy Auto Man Indianapolis